When trendy foods pop, suppliers and retailers have to be ready — or figure out how to make adjustments fast — to meet demand. In this age of food as social media fodder, we looked into the reality of getting more açaí, seaweed and turmeric on shelves — stat!

Açaí

Açaí bowls are Instagram shark bait. How can you resist snapping a photo of a beautiful deep-purple smoothie bowl layered with tart red strawberries, fat blueberries and flaky white coconut?

It’s almost unfathomable that just 20 years ago, few Americans had even heard of this tiny Amazonian super fruit. Sambazon co-founder Ryan Black says his açaí company struggled to get people interested in the palm fruit “because they hadn’t ever heard of (açaí) and couldn’t pronounce it.” (It’s AH-SIGH-EE.)

Sambazon’s attempts at açaí education have helped drive açaí to the top, as have the influence of social media word of mouth and a surge for health foods. Get enough people declaring something is good, and their Instafriends will want to try it themselves. As of today, #acaibowl is winning Instagram with 885,608 public posts — while the health food of yesteryear, #avocadotoast, nets only 653,172 posts.

In 2016, more than 300,000 tons of açaí products were sold across the world. By 2026, that number should be above one million tons. To keep up with demand, “we have increased sourcing and production in the last few years,” says Sambazon co-founder Jeremy Black. Sambazon owns a processing facility in the Amazon. They have vertically integrated production to streamline their work and protect the delicate fruit, which needs to be quickly processed because it rots.

For a product that feels very 21st century, the harvesting method remains surprisingly ancient and human. Workers scale the trees, pick the fruit and place it in woven baskets to be moved rapidly downstream to the processing facility. The company has been careful to ensure the sustainability of its açaí business by hiring locals to wild-harvest and hand-pick açaí, as well as to plant new seeds.

So far, there doesn’t seem to be an açaí shortage. But what if demand exceeds expectation, or if açaí bowls become the new favorite of a huge market like China? Can the Amazon handle the future of açaí?

Seaweeds

“Civil Eats,” the 2014 James Beard Foundation Publication of the Year, calls seaweed “the next big thing in sustainable food.” McCormick Spices identifies furikake as a spice to look out for in its 2018 Flavor Forecast. And the World Bank considers it an ecological product that’s also a problem-solving darling when it comes to feeding Earth’s hungry population.

Seaweed is of course a staple in Asia, where kombu, nori and wakame are consumed daily in soups, seaweed rolls and side dishes. According to the FishStat (2014) Electronic Fisheries Database of the Food and Agriculture Organization of the United Nations, nearly all — 99.4 percent — of the world’s seaweed, is produced in Asia. While Asia has long been seaweed-mad, in the western world nori is suddenly popping up in packaged snacks and in all-American foods you wouldn’t expect, such as popcorn, mayonnaise, smoothies, burgers and hot dogs. Seaweeds are versatile and are produced in many forms to suit many tastes — from a funky fried hijiki tofu burger popular at a New York University student fave called Dojo, to pungent wakame “birthday soup” at L.A. Koreatown’s Hangari Bajirak Kalgooksoo, to Uchi’s clean-cut, nori-wrapped negihama roll in Austin. It’s a far wider array than the leaves of wakame swimming in your Japanese miso soup.

“It is definitely a trend, similar to the recent kale craze,” says Michael Graham, creator of Monterey Bay Seaweeds. “There are flavored nori sheets and seaweed salad in Costco. These are not new products, but they are new vendors, and they are reaching new customers.”

Graham, also a biology professor at Moss Landing Marine Laboratories and the editor of a seaweed scientific journal, says he receives dozens of emails and calls a month from people who want to know more about seaweed. “I don’t know if the interest will last many years,” Graham says. “But regardless, it’s positive. Seaweed really is all that it is cracked up to be — so good for you, and good for the environment.”

Seaweed farmers are responding to the demand. From 2011 to 2012, the most recent years for which World Bank figures were available, global production of one of the most commonly eaten seaweeds, red nori (the dry, crispy wrappers of your maki rolls), increased by 13.57 percent, or 82,634 wet metric tons. Global production of an even more popular seaweed, wakame, ramped up by 21.94 percent, or 384,973 wet metric tons. Overall, including other seaweeds, global production in 2012 was approximately 3 million tons dry weight, increasing by 9 percent per year.

By 2050, if the World Bank has its way, we’ll be producing 500 million dry tons of seaweed, adding 10 percent to our current food supply. That’s definitely all-you-can-eat maki. To do that, we’ll have to augment seaweed farming by 14 percent per year. And the bank thinks we could do that in only 0.03 percent of the ocean’s surface area. More for less is usually a scam, but seaweed may be the bargain store of the sea.

Watch Mike Graham excite chefs with his land-based seaweed farm in Monterrey, California. Video by Zagat.

Watch Mike Graham excite chefs with his land-based seaweed farm in Monterrey, California. Video by Zagat.Turmeric

While Americans have just “discovered” golden milk (aka moon milk, golden latte or turmeric tea), its origin is an old Indian drink called haldi doodh. But its new in-demand status as an anti- inflammatory health food means turmeric, an ancient Ayurvedic root, has staked its spot in the mainstream American pantry.

Turmeric has hit the big time financially, shooting up from $2,700 million in 2012 to more than $3,160 million in 2016. By 2021, according to a report on Technavio, the global turmeric market is projected to post a compound annual growth rate of 6 percent (other sources list it as 5.5 percent by 2027).

“Volume is exploding for organic turmeric,” says Kai Stark, commodity manager at Frontier Co-op, a cooperatively owned wholesaler of natural and organic products based in Norway, Iowa. “In the last 10 years, the amount of organic turmeric Frontier Co-op has purchased increased by a factor of 10.” Despite the demand, turmeric farmers are struggling to stay alive, even as golden lattes sell for $15 per cup in the United States.

Approximately 80 percent of turmeric is grown in India, both wild and farmed. But the small margins are leaving some Indian farmers high and dry. To fight this turmeric poverty, Frontier Co-op collaborates with an organization called Peermade Development Society. PDS works with marginalized farmers, especially women and poor rural folks, to develop both the land and the farmers’ budgets sustainably.

“In the past, marginal farmers, who have only one to two hectares of land, would sell their commodities to middlemen for a small price, and then middlemen would sell again, taking the entire margin,” Stark says. “PDS Organic Spices came in to eliminate the middlemen and help these farmers sell directly to companies like Frontier Co-op.”

In 2009, as the turmeric craze began to take hold, Frontier supported a PDS program to scale up their farmers’ organic turmeric production. PDS, with Frontier’s help, began trials to grow a variety of turmeric with a higher content of curcumin, the potent antioxidant and anti-inflammatory in turmeric. Frontier also diversified its organic turmeric supply chain, adding suppliers from Central America.

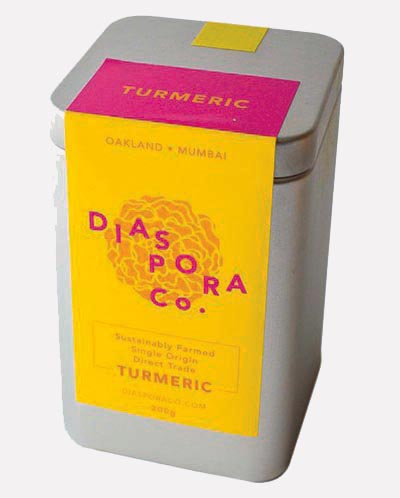

Sana Javeri Kadri, owner of Diaspora Co., a sustainable, single-origin, direct-trade turmeric company, also cuts out the middleman to bring maximum profits to her turmeric farmer, Mr. Prahbu, in Andhra Pradesh.

Javeri Kadri founded Diaspora Co. as a small side project but was inundated with high demand from the start. When her first four batches of turmeric sold out within hours, she contacted Mr. Prahbu and asked for everything he had. Her last batch sold out in about six weeks. Between filling 20 to 100 orders a week, she closely manages 12 wholesale accounts, asking buyers for six-month projections so Mr. Prahbu has adequate time to plan.

Javeri Kadris says turmeric is planted between May and June, before monsoon season, when it soaks up all the rain. Harvest happens between January and February, so the timing is important — as are the seeds.

“Find the seeds your grandma was using, before the British showed up,” Javeri Kadri says. “If you don’t protect biodiversity, you end up with the heartiest tomato that will survive the grocery store but doesn’t taste very good. It’s the same with turmeric — we’ve already got this mass-marketed bright yellow turmeric with a mild smell, with no biodiversity or cultural history.” Her explicitly political mission is to preserve pre-colonial biodiversity, create the best-tasting, most diverse array of turmerics and reward turmeric farmers in India while doing it.

Still, we can expect the inevitable when it comes to trends: strange products like turmeric-flavored coffee creamer, croissants and cronuts, and frozen turmeric shakes (despite Ayurvedic wisdom that turmeric should be eaten heated for optimal benefits). Because when a trend takes hold, reason may exit through the pricey gift shop, in the form of a chai golden milk donut that screams, “I <3 turmeric.”

Author

Dakota Kim is a nomadic food and TV writer based in Southern California.